Investing in Early-stage Venture in 2025: What to Look for

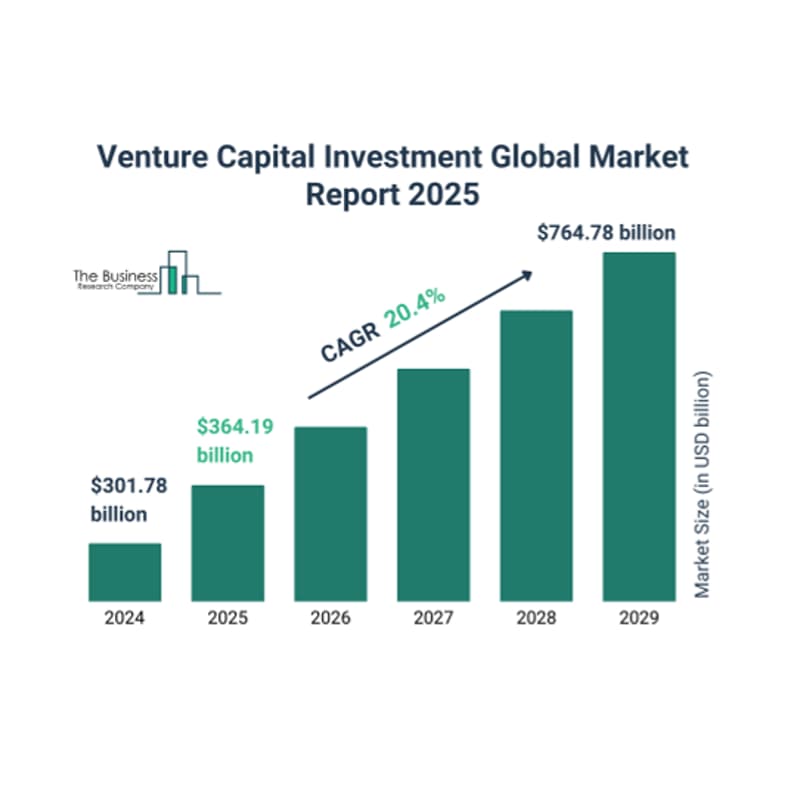

Venture capital remains one of the most compelling asset classes for high-net-worth individuals, offering access to innovation and outsized returns. However, navigating fund selection, risk management, and due diligence is critical to making informed investment decisions.

Join us for an exclusive online event with our Managing Partner Ihar Mahaniok, discussing the current early-stage VC landscape.

We will cover investing in early-stage from multiple perspectives:

If you have never invested in a startup or a fund, this event is for you. We will cover basics:

how much to allocate to early stage

how to find and pick deals to invest in

investing in startups vs funds

expected timelines, returns, risks

tax considerations

portfolio composition

If you have some startups or funds in your portfolio, this event is for you too. We will discuss what is different in 2025, how AI affects investing and allocation, and what we see in the future for the VC asset class.

This is a one-hour virtual event with a presentation and Q&A, open to accredited investors ($200k/year income or $1M in assets).